Postbank Online Banking

The IBAN system helps guide payments, typically international settlements, to the right account, by giving the banks processing transfers an indication of the country the account is held in, as well as the specific account number.

As we have already informed you, the acquisition of the majority stake of the capital of Piraeus Bank Bulgaria AD (Piraeus Bank) by Eurobank Bulgaria AD (Postbank) was finalized on 13 June 2019. On November 12, 2019, the legal merger of the two institutions took place. Welcome To Kenya Post Office Savings Bank Welcome ! @ # $ ^ &.`. Postbank, legally named Eurobank Bulgaria AD, is the fifth biggest bank in Bulgaria in terms of assets, having a broad branch network across the country and a considerable client base of individuals, companies and institutions. In June 2018, Bulgarian Credit Rating Agency (BCRA) confirmed Postbank’s BBB- long-term rating, with stable outlook.

What is IBAN code for Postbank in Germany?

IBAN for Postbank in Germany consists of up to 22 characters:

- 2 letters ISO country code

- 2 digits IBAN check digits

- 8 digits BLZ

- 10 digits Account Number

Postbank example for Germany

| Postbank IBAN in print format | DE89 3704 0044 0532 0130 00 |

|---|---|

| ISO Country Code | DE |

| Checksum | 89 |

| BLZ | 37040044 |

| Account Number | 0532013000 |

How can I find my Postbank Germany IBAN number?

To ensure your money quickly reaches the right account, it's essential to find the correct IBAN. Finding your Postbank IBAN shouldn't be difficult. You can either use the example above to work out your IBAN, use an IBAN generator tool, or you can find everything you need by logging into Postbank online banking.

Using an incorrect IBAN number could mean that your payment gets returned, or even arrives in the wrong account. If you're unsure, it's important to check the IBAN with your bank or ask the recipient to confirm the correct details.

Please note that any IBAN or BBAN account numbers which appear on this page are used as examples, and shouldn’t be used to process your transfer. To find your own unique IBAN, click the IBAN Calculator in the section below.

Generate & Validate IBAN

Click 'Generate' below to use the IBAN Calculator, or 'Validate' to check an IBAN for a bank account in Germany.

IBAN Codes for Main Germany Banks

When you send or receive an international wire with your bank, you might lose money on a bad exchange rate and pay hidden fees as a result. That’s because the banks still use an old system to exchange money. We recommend you use TransferWise, which is usually much cheaper. With their smart technology:

- You get a great exchange rate and a low, upfront fee every time.

- You move your money as fast as the banks, and often faster – some currencies go through in minutes.

- Your money is protected with bank-level security.

- You join over 2 million customers who transfer in 47 currencies across 70 countries.

IBAN number - FAQs

What is an International Bank Account Number (IBAN)?

An international bank account number - more commonly abbreviated to IBAN - is typically used when sending payments overseas. The IBAN system helps guide international payments to the right account, by giving the banks processing transfers an indication of the country the account is held in, as well as the specific account number.

How does an IBAN work?

IBANs follow an internationally agreed system to show the country an account is held in, as well as the individual’s basic bank account number. You’ll find each IBAN has a 2 letter country code, followed by 2 check digits and the individual’s own basic bank account number.

Postbank Online Banking App

IBAN numbers can be different lengths depending on the country they’re from. This is because different countries use basic bank account numbers of varying lengths.

IBAN vs. SWIFT Codes

SWIFT codes - which are also known as BIC codes - are also used in international payments. If you’re sending money overseas you’ll often be asked to provide both the SWIFT/BIC code and the IBAN for the recipient’s account. However, these 2 codes each have different purposes. The SWIFT code identifies the bank the payment is headed to, while the IBAN gives the details of the specific account the deposit needs to end up in.

Requirements for International Bank Account Numbers

You’ll find IBANs have different numbers of digits - but they all contain the same information. The first 2 characters show the country the payment is going to, followed by 2 check digits which are used to verify the IBAN before it’s used for a transfer. The digits that follow are the individual’s basic bank account number, which shows the account number and bank branch to help guide the payment.

Do you need an IBAN in Germany?

Yes, you’ll need an IBAN if you’re making an international money transfer to Germany.

A standard bank account number isn’t enough. If you're making or receiving a payment to a Postbank account and you want your money to arrive quickly and safely in Germany, you’ll need to provide the bank with a few extra details. This generally includes an IBAN or SWIFT code.

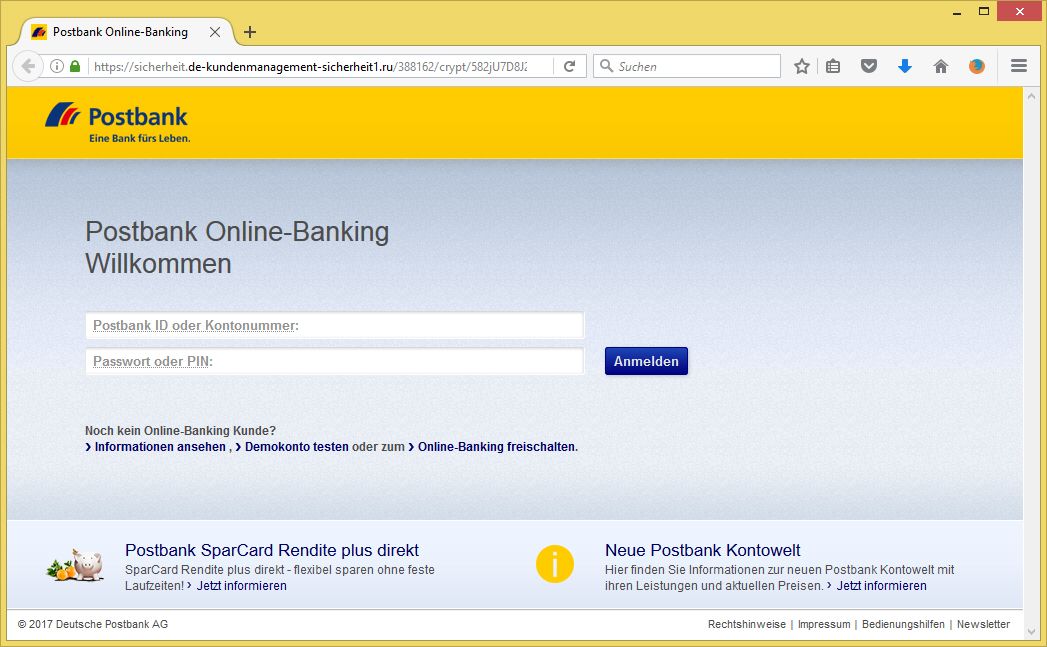

Postbank Online Banking overview

Like many other modern banks, Postbank offers online banking to its customers, enabling online access to their bank accounts so they can manage their finances at their convenience without needing to visit a bank or wait for customer service. As more clients had opted online to handle their finances or any other business the help available through online banking or any other internet account management is only going to be a more integral a part of handling finances.

Customers can register for Postbank online banking by visiting the Postbank website and filling out the enrollment information, which will require basic account information. After registration is finished clients may have a login ID and password for Postbank internet banking, which they’ll use to log to the service, and really should keep protected against loss or thievery whatsoever occasions.

Postbank features a video demonstration of the very common features on its site, and clients not really acquainted with internet banking or a new comer to Postbank generally would prosper to take advantage of the feature, because they will have the ability to acquaint themselves using the services supplied by Postbank and can then have the ability to make smarter use of time when going to the website.

While it is unlikely customers will ever be able to bank entirely through an internet connection from a home computer (check deposits will not likely reach the point of reliable digital deposit), Postbank does feature a range of services so that customers can perform many of the most commonly used functions related to banking and account management, so that customers can go for lengthy periods of time with no need to visit the actual bank location.

Postbank Online Banking security features

Postbank makes use of the current standard for digital security found across the globe, which currently includes digital encryption protocols which are unbreakable my current computers without being given thousands of years to attempt to break the code. Postbank also uses fire walls which prevent outdoors accessibility communications between your user and Postbank. Customers also log in with a unique user ID and password, which they should keep memorized if possible, or kept somewhere safe from loss or theft.

Customers should be aware of the fact that despite all the security measures set in place by banks and other business institutions across the globe, it is not possible given current technological standards to guarantee complete online security, and customers should be aware of the risks and how to minimize the potential threat of online fraud or identity theft.

Postbank Online Banking Entsperren

Clients should make use of the latest anti-virus software to reduce the threat from infections, trojan viruses horses along with other malicious software packages, and really should avoid divulging either their user title or password to anybody, especially through unpredicted sources for example anonymous email or SMS text, that are frequently disguised to resemble the financial institution itself, and therefore are quite harmful, particularly the links within them.. Public computers should be avoided if possible, as they may not have adequate levels of security, and customers should log out of the banking session when finished. By taking these measures into consideration customers should have little difficulty enjoying the benefits provided by Postbank online banking login.